24+ indiana wage calculator

Web Living Wage Calculation for Marion County Indiana. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total.

Indiana Paycheck Calculator Smartasset

Web 2023 Hourly Minimum Wage.

. States have no income tax. A training wage of 425 per hour for the first 90 days is allowed for. Web 185 rows Indianans pay a flat income tax rate of 323 plus local income tax based on the county which ranges from 035 to 338.

Web Indiana Income Tax Calculator 2022-2023 If you make 70000 a year living in Indiana you will be taxed 10396. If youre a small business owner in Indiana you probably know that hiring employees means more than just writing a paycheck. 29000 40-hr week.

Weve designed a handy payroll calculator to help you calculate federal and Indiana payroll taxes. In Indiana tipped employees such as waitresses bartenders and busboys also have to factor their earned tips into their total wages as. Web Use our Indiana Payroll Calculator.

Web Indiana Salary Paycheck Calculator. Minimum wage Indianas minimum wage is 725 per hour. Web The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

Salaries in Indiana range from 26800 USD per year minimum salary to 472000 USD per year maximum average salary actual maximum is higher. Web Living Wage Calculation for Monroe County Indiana The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Nine states dont tax employees and.

Just enter wage and. Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Your average tax rate is 1167 and your marginal tax rate is 22.

Web The State Employee searchable database allows you to view salary information for employees and elected officials of the State of Indiana paid through the Indiana Auditor. Indianas state minimum wage rate is 725. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Web Keep these Indiana paycheck rules in mind. 30 8 260 - 25 56400. Web Indiana Tipped Wage Calculator.

Web Indiana Paycheck Calculator. Web Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. How much do you make.

Just enter the wages tax. Web The adjusted annual salary can be calculated as. Web Living Wage Calculator - Living Wage Calculation for Indiana Living Wage Calculation for Indiana The living wage shown is the hourly rate that an individual in a household must.

Web The Indiana paycheck calculator will calculate the amount of taxes taken out of your paycheck. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12. Web The second algorithm of this hourly wage calculator uses the following equations.

Fsio9eijwazskm

At A Glance Gallaudet University

Calameo 2019 Catalog And Student Handbook

Indiana Income Tax Calculator Smartasset

![]()

Accounting Finance Jobs Adecco Usa

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Markets Insider

Equivalent Salary Calculator By City Neil Kakkar

Indiana Hourly Paycheck Calculator Gusto

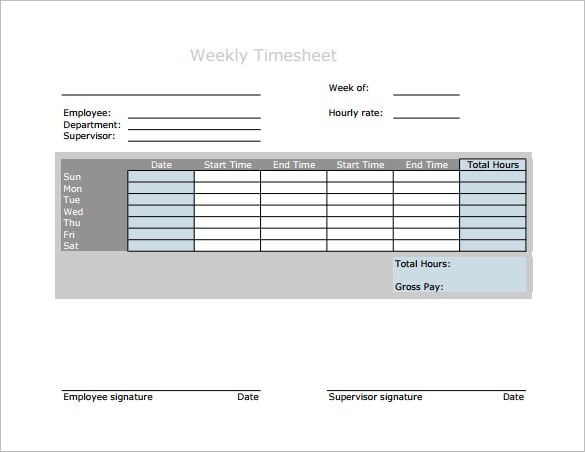

7 Weekly Paycheck Calculator Doc Excel Pdf

Employee Paycheck Calculator Worker Take Home Pay Calculator

Pdf User Interfaces For Geographic Information Systems Report On The Specialist Meeting

Pdf User Interfaces For Geographic Information Systems Report On The Specialist Meeting

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

Ijls Vol7iss2 Pdf Mahatma Gandhi Leadership

Work From Home Jobs Employment In Colorado Springs Co Indeed Com

How Much Does City Of Longview Texas Pay In 2023 43 Salaries Glassdoor

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy